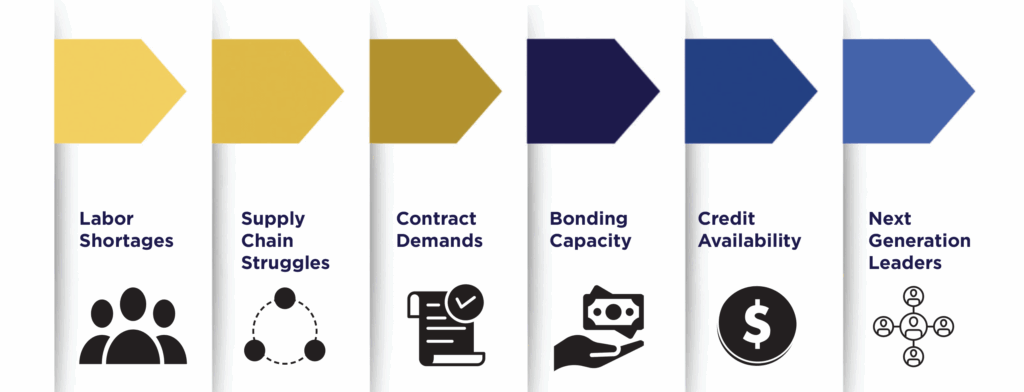

Construction – Emerging Risks

Schedule Your Risk Profile Assessment

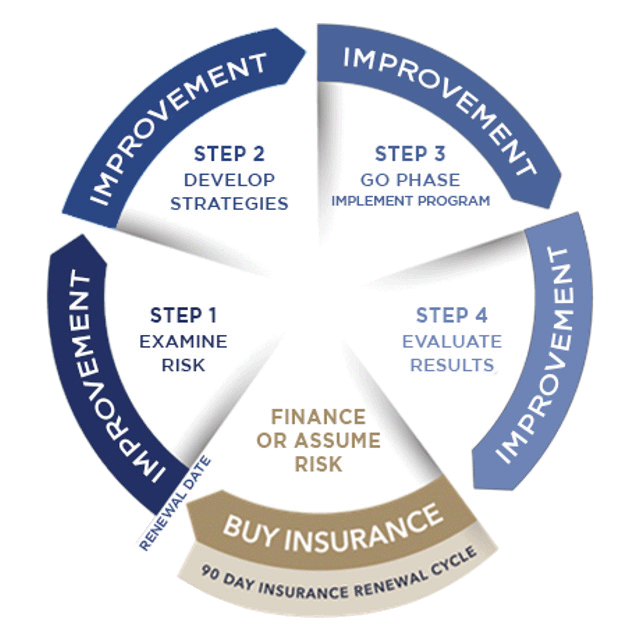

The goal of a risk profile is to provide an unbiased understanding of your organization’s ability to address risk by assigning a score to different types of risks and the danger they pose. By staying on top of potential threats, we can help you plan and control for emerging risks through documented and measured strategies designed specifically for your organization.

What is Your Score?

Intelligence Quotient For Risk Management

1. Examine Risk

We will investigate your potential risk by asking questions to determine your specific needs.

2. Develop Strategies

We will design a custom plan to improve your Risk Profile.

3. Go Phase

We will work with your to make sure the plan is executed.

4. Evaluate Results

Our process continues with accountability and monitoring the measured results of the program.

Know Your Score!

Our Construction Risks Team

Chief Sales Officer

Vice President of Business & Association Development

Advisor

Advisor

Advisor

Advisor

Advisor

Advisor

Vice President of Claims and Administration

Commercial Risk Account Executive