CLICK EACH CASE STUDY BELOW TO SEE DETAILS:

Case Study #1 - Benefits Education Program Improves Employee Satisfaction

If an employee benefit exists but nobody knows about it, does it really exist? The simple answer is “no.”

If an employee benefit exists but nobody knows about it, does it really exist? The simple answer is “no.”

This multiple-location client struggled to educate remote workers regarding benefits, causing frustration and extra work for all involved. To the employer’s disappointment, this resulted in remote workers underutilizing employer paid benefits. To help solve the problem, Ollis/Akers/Arney developed a strategy to use the client’s payroll and benefits enrollment system to provide consistent education and easy access to how the program worked and what resources were being offered.

The communications program included plan component video clips regarding different aspects of the plan (medical, dental, vision, life, etc.) and electronic delivery of specific e-flyers that were timed and targeted throughout the year. A mobile app option was also made available to employees for easy access to their selected plan components.

This use of technology improved remote employee satisfaction and decreased the time commitment for the HR team.

Case Study #2 - Health Department HR Improvements Not Hindered by Pandemic

Imagine leading a county health department in May 2020. The pandemic had the director hyper-focused on pandemic related issues. The director had objectives to enhance the department, but limited bandwidth to implement the vision. The health department called on the Ollis/Akers/Arney Human Resources Consulting Team to provide comprehensive assistance.

The team started by developing an employee handbook that established policies, so everyone was on the same page regarding expectations. They then evaluated what competencies and skills an individual needed to possess to perform each job, helping the department hire, train, and work on any performance issues.

The team started by developing an employee handbook that established policies, so everyone was on the same page regarding expectations. They then evaluated what competencies and skills an individual needed to possess to perform each job, helping the department hire, train, and work on any performance issues.

In addition, they:

• wrote job descriptions,

• recruited employees,

• implemented behavioral based interviewing,

• completed compensation analysis,

• maintained compliance audits,

• developed safety and ergonomic programs, and

• trained employees.

The director was able to successfully lead the organization during one

of the most trying times for health departments throughout the country and simultaneously implement much needed HR improvements and remains a client today.

Case Study #3 - Property Review Helps Control Costs

Risk management for larger companies is unique in that they have multiple exposures within the confines of their organization. Whereas some businesses routinely have only a handful of specific risks they have to oversee, this large employer had numerous and complicated risks to consider and manage.

Ollis/Akers/Arney has invested in tools and resources that can be tailored to the individual needs of a business to improve the Client Risk Profile. One resource provided to the company with extensive building assets

was a complete property review including photos, building schedules, updated valuations, and confirmed appropriate coverage limits.

The company was provided a detailed book for their records. This book helped the decision makers understand their current assets and budgetary expectations early in their planning process.

A complete property review helps the company control costs and budget to make updates, which minimize potential risks. It is also an important component to help inform carrier selection for those who have the best fit, structure, and risk appetite.

Case Study #4 - A Pound of WorkComp Prevention

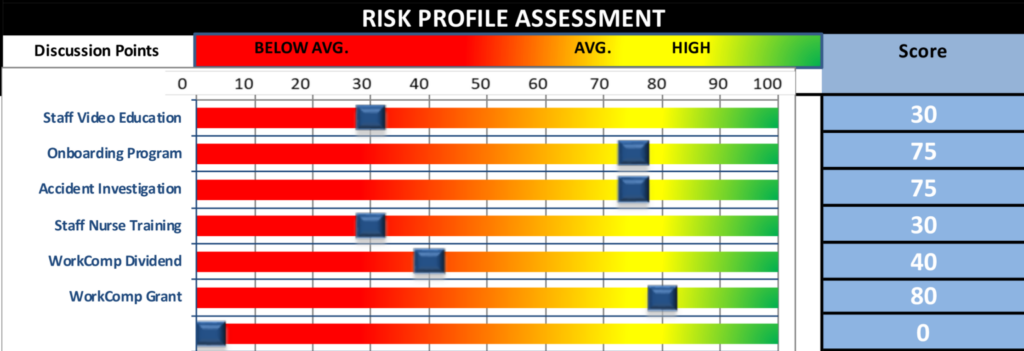

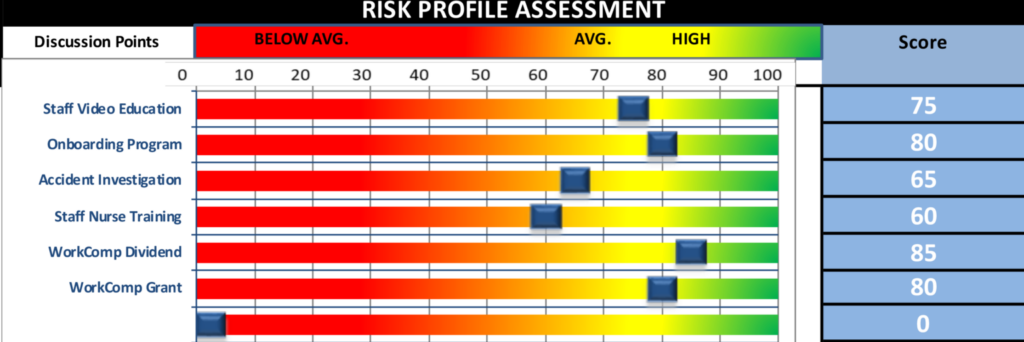

Prior to Ollis/Akers/Arney involvement this client was unaware of their problematic WorkComp Experience Modifier. This is a number that reflects how well an organization manages their Workers’ Compensation program. An Experience Modifier below 1.0 is good and above 1.0 is bad. This company was “running a fever” with a 1.7 Experience Modifier resulting in higher premiums than similar entities.

The person in charge of the insurance program was not aware that it was within their power to take action to improve their score to alleviate program expense. A better Experience Modifier does not happen overnight, but with diligence can be continuously improved year over year. Following assessment of contributing factors, in coordination with the client, the Ollis team focused on these areas:

- Implementing custom video training to be used during onboarding and by all employees annually.

- Educating onsite nurses regarding the difference between First Aid and Workers’ Compensation claims.

- Partnering with the client’s Safety Team to develop a yearly structure of meetings and content for employees.

- Updating the driver safety program, educating the department leads on the updates, and assisting with the communication plan to all employees.

- Facilitating a meeting with the client and Workers’ Compensation carrier, to ensure all rebates/dividends available to the client were being received

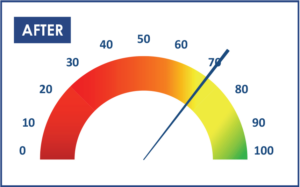

Before

After

Assess Your Risk

Assess Your RiskCase Study #5 - 60-Day Scramble to Build HR Functions

A well-established, mid-size company knew bringing all of their HR functions in-house for the first time would be a fundamental change to how their company operated long term, but they did not realize they would have a head-spinning 60 days to build everything from scratch with no guidance, documentation, or employee records from their longstanding professional employer organization (PEO).

A PEO provides full-service human resource outsourcing including payroll and benefits and serves as employer of record. When the company notified the PEO of their intent to bring all HR functions in-house, that’s when they learned they would not gain access to their records.

The Ollis/Akers/Arney HR Consulting team helped transition to in-house management of their staff and set up the HR functions:

- Rehire all existing employees.

- Conduct onboarding and transition meetings with employees.

- Recreate all HR forms, documents, employee handbook and

training programs.

This 60-day whirlwind helped ensure this company provided a smooth transition for all employees. This company continues to partner with the Ollis team to provide a sound structure for long-term human resource success.

Case Study #6 - Frenzied Decisions Torment 500-Employee Company

Late renewals, no long-term strategy and challenged communications with prior insurance providers plagued this 500+ employee company. Lack of structure and timeliness resulted in a rush to market for benefits quotes and hastily reviewed plans.

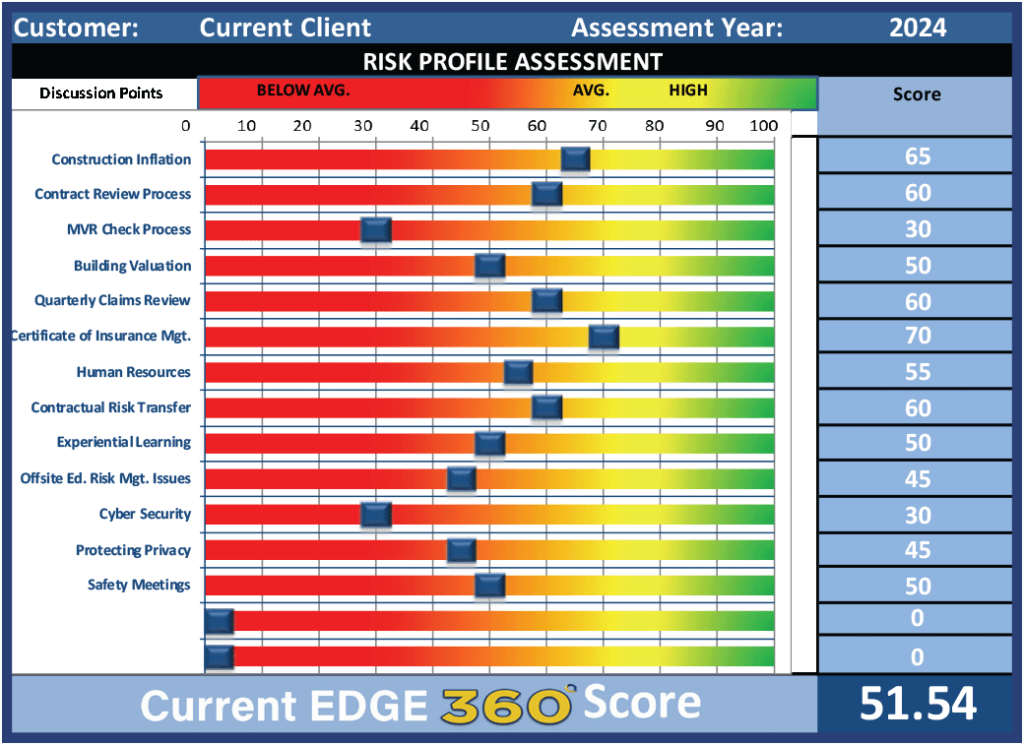

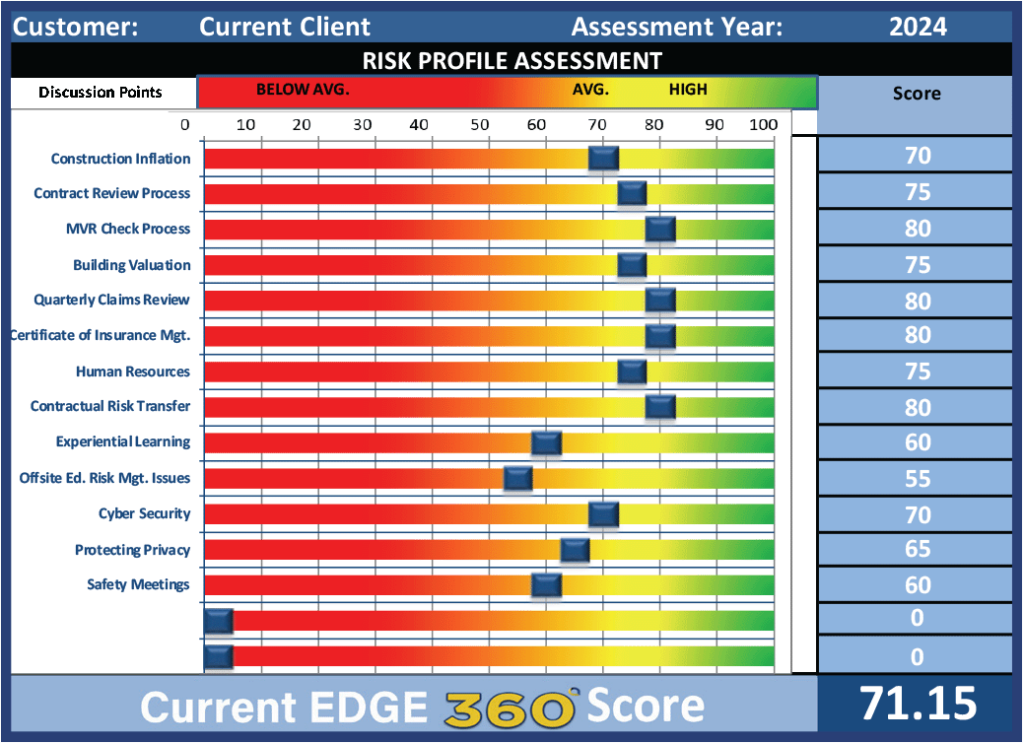

Decision makers recognized this risked unnecessarily high premiums and unintended gaps in employee benefits, jeopardizing employee attraction and retention. After completing the Ollis IQRM Assessment, they opted for the Ollis EDGE 360 model, which is exclusively offered to Ollis/Akers/Arney clients. The Ollis EDGE 360 model includes three main things to ensure structure and timeliness:

- As We Agreed – Communication immediately following client meetings that identifies key areas discussed, next steps, and who is responsible for completing those action items and by what date. These letters serve as proof of accountability.

- Preferred Client Agreement – A mutually agreed upon annually revised calendar that assists in the implementation of strategies in a documented timeline including expected implementation, dates, resources, and analysis months in advance eliminates guess work or last-minute rush as an alternative to what many business leaders face today when working with the traditional insurance model vendors.

- Risk Profile Assessment – An overview of key drivers of exposure to the client, risk management strategies, along with plan performance and data analysis reviews are updated periodically to measure success.

Once the process was aligned for this client, focus could turn to data analysis, evaluation of benefits and future strategies rather than a frenzied, reactionary response. The Ollis team worked closely with them to develop a strategic plan that included a story to the insurance marketplace and a communication plan to improve the education of the employees around the benefits program. The documented and calendared process eliminated last-minute meetings and mitigated the stress of the renewal/open enrollment window.

Once the process was aligned for this client, focus could turn to data analysis, evaluation of benefits and future strategies rather than a frenzied, reactionary response. The Ollis team worked closely with them to develop a strategic plan that included a story to the insurance marketplace and a communication plan to improve the education of the employees around the benefits program. The documented and calendared process eliminated last-minute meetings and mitigated the stress of the renewal/open enrollment window.