The insurance marketplace is a funny place; pricing and availability can appear and disappear seemingly at random, and predicting changes is more an art form than a science. Some years, insurance buyers benefit from falling costs and expanded coverage. Other times, when markets harden, business owners must make tough choices regarding their insurance and loss control programs. Understanding how business owners and risk managers can prepare for an insurance “hard market” —and putting those preparations into practice—can help your firm maintain a strong financial position complete with adequate protection for your organization.

Insurance Cycles

The insurance market waxes and wanes in unpredictable cycles, vacillating between hard and soft markets. When insurance pricing is stable or falling, it is referred to as a soft market. Soft markets have generally predominated in recent decades.

Hard markets, on the other hand, are characterized by quickly rising insurance premium costs and shrinking capacity by insurers. During hard markets, insurance buyers are often forced to forego excess coverage, sacrifice investments or revise budgets to accommodate skyrocketing insurance costs.

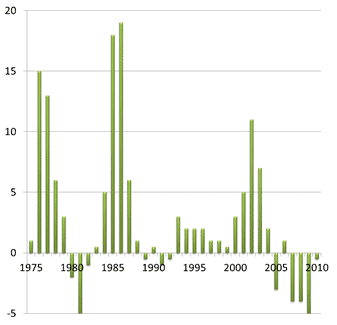

In order for a market to be considered hard, prices must generally increase an average of 15 percent across the board; as you can see below, rising prices can average as high as 25 percent for three consecutive years. These sudden swings are usually unpredictable, and can greatly affect your ability to protect your business.

Percentage Change from Prior Year in Net Premiums Written

Hard markets have been surprisingly rare—occurring only four times during the last half century. While they often occur quite suddenly and without much warning, recent market conditions have seen a gradual hardening.

Often, a large catastrophe—either natural or economic in nature—is the trigger for a hardening market. That being said, certain conditions can exist that make an appearance of a hard market more likely; think dry air before a thunderstorm. The hard market from 2001 to 2004 was largely precipitated by the events of 9/11 and exacerbated by the massive losses associated with Hurricane Katrina. Even though the market truly hardened in 2003, the conditions for hardening existed as early as 2001. Those same precursors, namely diminished reserves held by insurance carriers as well as decreased underwriting profits, reemerged in the insurance marketplace in 2011.

In addition to the devastation wrought in 2012 by Hurricane Sandy, 2011 was actually the costliest year for the insurance industry in terms of natural catastrophic losses from a large number of weather-related disasters, especially earthquakes. Given 2011’s natural disasters, many predicted the insurance market would “harden” to account for all the losses, and it has been hardening gradually with an overall increase in rates.

If the Market is Soft, When Do I Worry?

Many business owners are inclined to ride a soft market, meaning they renew their policies and simply appreciate their falling insurance costs. While insurance savings are a nice surprise, using your new windfall for purposes other than protecting your business can have both short- and long-term consequences.

Forward-thinking business owners and risk managers use the soft market to their advantage, continuing to invest in their firm to mitigate losses and expand coverage. Take action to address losses now by following these best practices:

- Increase coverage while you can: One of the hallmarks of a hard market is the decrease in risk appetite by insurance carriers. During the soft market, insurers are competing for your business. When that market hardens, you’ll be competing for coverage. By increasing your excess coverage while prices are low, you can drastically improve your negotiating leverage down the road. You’ll likely be able to retain existing coverage (in a climate of sharply rising prices) or give up some coverage in exchange for a price decrease. In either case, you’re better off.

- Explore the possibility of program restructuring: In some cases, underwriters are willing to write multiyear policies; many risk managers have used this tactic to secure terms and coverage while avoiding costly price increases.

- Invest savings in loss control measures, safety management and capital improvements: The decreasing cost of insurance premiums presents a unique opportunity; rather than absorbing the savings, make investments in loss control and safety to achieve additional savings down the road. Insureds who have continually invested in their facilities and workforce, who make safety and loss control top priorities, will be far more attractive to underwriters with strict pre-requisites for coverage.

The soft market isn’t just a pricing advantage—it’s an opportunity. Taking full advantage of the soft insurance market isn’t simply about achieving premium savings, it’s about positioning your firm for the best situation down the road.

Selling Your Story to an Underwriter

Your relationship with an underwriter can make a world of difference during times of market upheaval. Hard markets make underwriters more critical, and it’s prudent to come prepared for any concerns the underwriter may address.

- Audit your information for accuracy: Accurate information is vital to the bid process; in many cases, potential insureds provide underwriters an inaccurate list of assets or employees. This swells their numbers, and their costs. Conversely, underreporting your payroll or overstating your assets can be characterized as fraud.

- Know your loss history: In a hard market, underwriters will be especially critical in discerning loss trends. You have to be prepared to explain the factors contributing to a specific loss and the steps you’ve taken to mitigate the risk of a future loss.

As the Market Hardens…be Prepared for Changes

Even the most prepared organizations will have to accommodate the changes that come with a hard market.

After more than 75 consecutive months of declining P&C insurance rates, premiums began trending upward in Q4 of 2011. Most analysts expect the market to continue adjusting slightly upward throughout the coming months. While there’s been a small increase in overall rates, a few commercial lines are seeing significant price increases.

Preparing for market changes takes an integrated insurance purchasing and risk management approach, where buyers are prepared for possible coming changes:

- Structuring insurance programs for maximum benefit: In a hardening market, some lines of coverage may simply no longer be cost-effective for your firm. Consider a situation in which supply chain insurance moves well outside the realm of affordability. The risk of a supply chain interruption remains, so to compensate it might be prudent to increase an alternative line to continue accommodating your firm’s overall risk appetite.

- Remember what’s important: If your broker deems it necessary, it may be time to shop your carrier to look for the most competitive deal. However, it’s important to evaluate your entire insurance experience. Certain carriers may be more competitive on price, yet not offer the same level of service or support. In addressing your total cost of risk, make sure you’re seeing the whole picture.

Business owners who proactively address risk, control losses and manage exposures will be adequately prepared for a hardening market. Work with your broker now to prepare your business for changes down the road.

Get Assistance

For help in keeping up to date on these issues affecting your business as well as business consulting, contact Ollis/Akers/Arney.