You have many choices when it comes to selecting a health insurance plan, which can make the process feel overwhelming. Keep reading to explore some of the major health plans and their key characteristics.

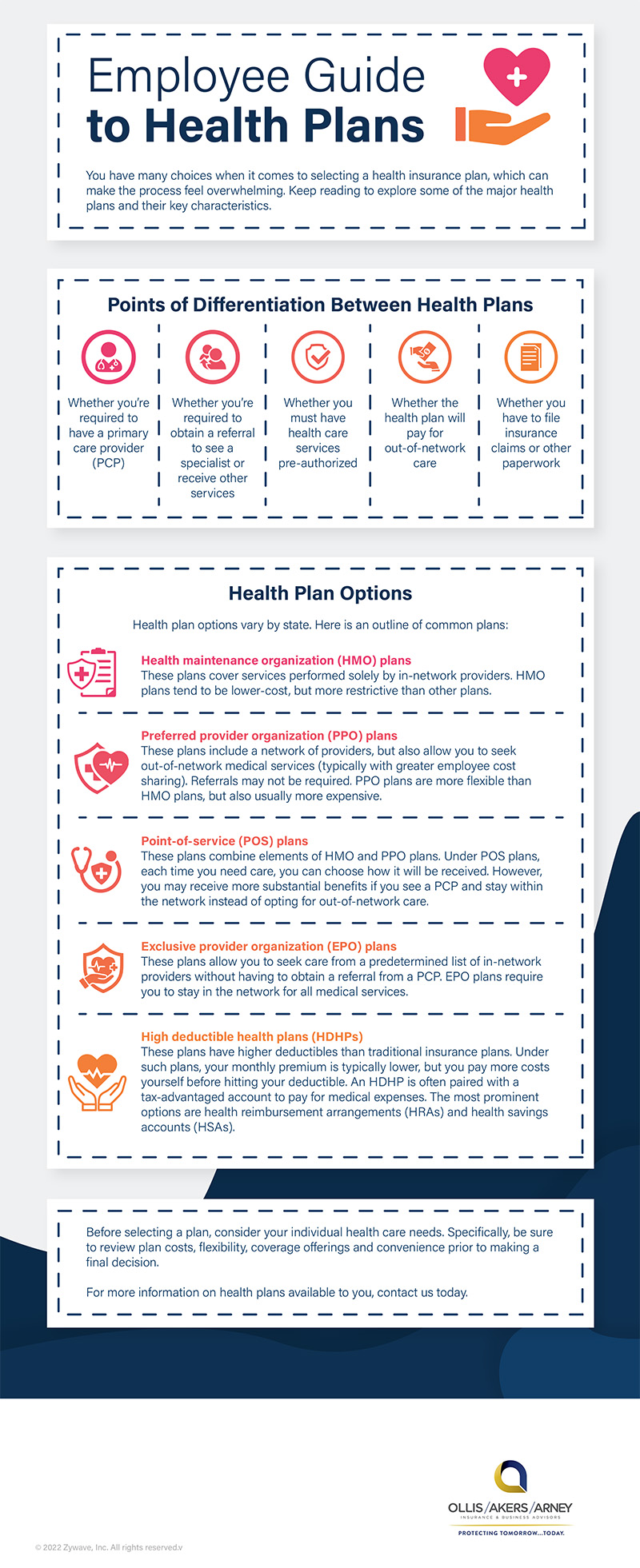

Points of Differentiation Between Health Plans

- Whether you’re required to have a primary care provider (PCP)

- Whether you’re required to obtain a referral to see a specialist or receive other services

- Whether you must have health care services pre-authorized

- Whether the health plan will pay for out-of-network care

- Whether you have to file insurance claims or other paperwork

Health Plan Options

Health plan options vary by state. Here is an outline of common plans:

- Health maintenance organization (HMO) plans – These plans cover services performed solely by in-network providers. HMO plans tend to be lower-cost, but more restrictive than other plans.

- Preferred provider organization (PPO) plans – These plans include a network of providers, but also allow you to seek out-of-network medical services (typically with greater employee cost sharing). Referrals may not be required. PPO plans are more flexible than HMO plans, but also usually more expensive.

- Point-of-service (POS) plans – These plans combine elements of HMO and PPO plans. Under POS plans, each time you need care, you can choose how it will be received. However, you may receive more substantial benefits if you see a PCP and stay within the network instead of opting for out-of-network care.

- Exclusive provider organization (EPO) plans – These plans allow you to seek care from a predetermined list of in-network providers without having to obtain a referral from a PCP. EPO plans require you to stay in the network for all medical services.

- High deductible health plans (HDHPs) – These plans have higher deductibles than traditional insurance plans. Under such plans, your monthly premium is typically lower, but you pay more costs yourself before hitting your deductible. An HDHP is often paired with a tax-advantaged account to pay for medical expenses. The most prominent options are health reimbursement arrangements (HRAs) and health savings accounts (HSAs).

© 2022 Zywave, Inc. All rights reserved.